An integrated planning approach for business owners and incorporated professionals.

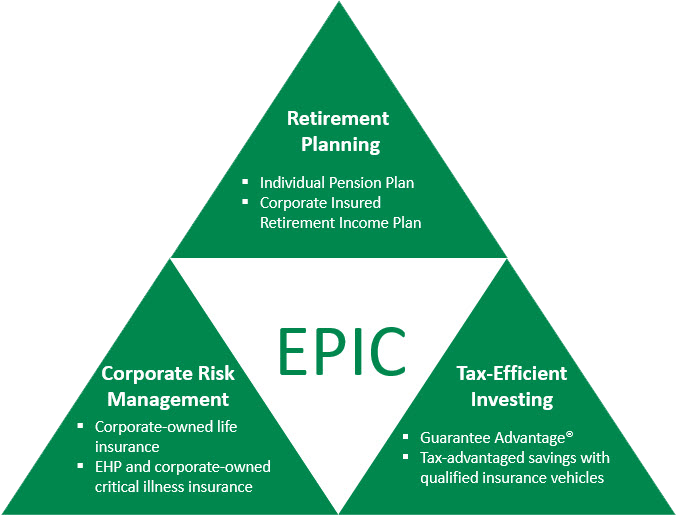

The Essential Passive Income Concept (EPIC) is a dynamic planning approach that will assist corporations address their long-term planning needs.

Available exclusively through Desjardins Insurance, EPIC will help differentiate advisors working in the corporate market. The goal of an EPIC strategy is to:

- Improve corporate risk management

- Enhance retirement planning options

- Address taxation issues brought on by the passive investment income rules

EPIC is a concept that brings together well-known solutions in a format that:

- Is client-friendly with a professional design

- Is concise yet robust enough to bring to the accountant

- Is customizable to the client’s specific needs

- Outlines the need for an ongoing planning relationship

Advantages

- Helps reduce the impact on the corporation’s Small Business Deduction (SBD) due to the passive investment income rules

- Enhances corporate liquidity in the case of a shareholder’s death or critical illness, if insurance is part of the solution

- Reduces the corporation’s tax burden, resulting in significant cumulative tax savings

- Improves retirement planning opportunities if an Individual Pension Plan or Corporate Insured Retirement Income Plan is part of the solution

- Creates more planning flexibility for your client and their corporation, now and into the future

Applicable products

Insurance:

- Corporate-owned life insurance: term, permanent, participating whole life, universal life – Term 10, 20 and Term to 100

- Corporate-owned critical illness insurance: Health priorities – term and permanent

- Executive Health Plan (EHP): Health priorities – business

Investments:

Retirement savings:

- Individual Pension Plan (IPP)