There are several dividend options to choose from when you offer participating life insurance:

- Paid-up additions (PUAs)

- Enhanced insurance

- Annual premium reduction

- Cash payment

- Dividends on deposit

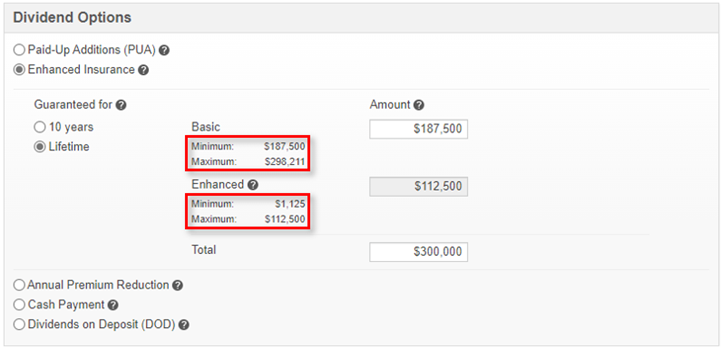

Illustration tool | Enhanced insurance

To better support you in your advisory role with your clients, we've improved how the Illustration tool addresses enhanced insurance. Now it

displays minimum and maximum amounts for

basic and enhanced insurance.

By making changes to the basic insurance, you can see the options for enhanced insurance and better meet the client's insurance needs.

Note: Enhanced insurance is the only dividend option available when you offer the 5 Pay PAR product.

Did you know?

- Choosing the

minimum enhanced insurance will

maximize the long-term cash surrender value and the amount payable upon death

- Choosing the

maximum enhanced insurance will

minimize the cost of insurance

- If you check the option "Guaranteed for

10 years"

- The enhanced amount is guaranteed for 10 years even if the dividends are not high enough to cover the premium for the 1-year term insurance (T1).

- If you check the option "Guaranteed for

Lifetime"

- The enhanced amount is guaranteed for life even if the dividends are not high enough to cover the premium for the 1-year term insurance (T1).

- T1 insurance can be converted into an eligible permanent life insurance product under certain conditions

To compare premiums for different scenarios, simply copy your illustration. To learn more, see the article

Illustration | Compare insurance illustrations. It’s easy!

Questions?

Actuarial Services and Insurance Solutions